Case Study: The Town of Dixon Fraud

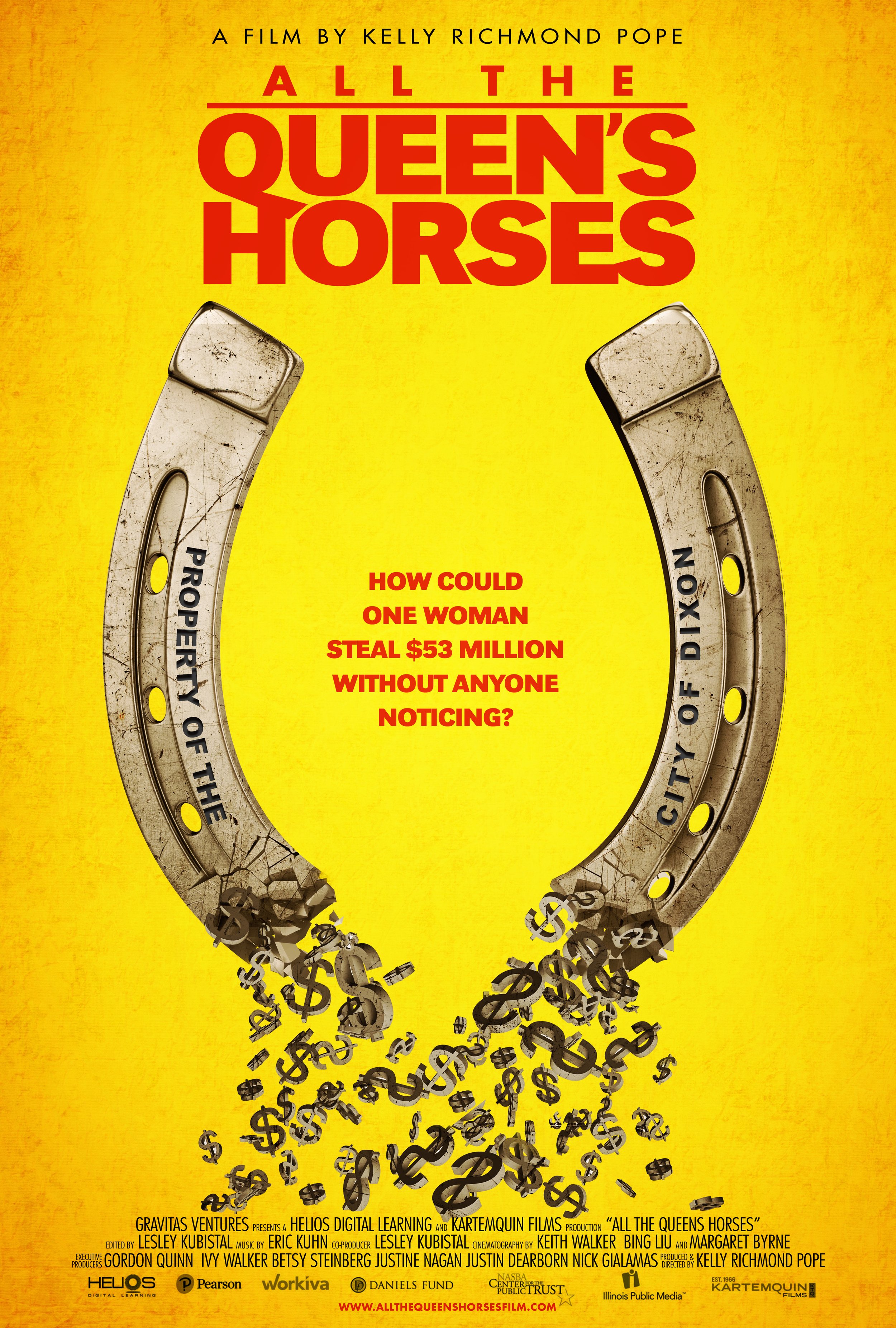

The Town of Dixon, Illinois, became infamous for one of the largest municipal frauds in U.S. history when Rita Crundwell, the town’s longtime comptroller, embezzled nearly $54 million over two decades. The fraud was cataloged in the 2017 documentary All The Queen’s Horses.

Crundwell's method of fraud involved creating a secret bank account named the "RSCDA" account, where she funneled funds intended for the town’s operations. She fabricated invoices for nonexistent services and transferred the money into the RSCDA account, subsequently using it to finance her lavish lifestyle, which included one of the nation’s most successful quarter horse farm and luxury items.

One of the most striking aspects of the Dixon fraud was Crundwell's ability to exploit weak internal controls and the absence of segregation of duties. She had almost complete control over the town's finances, allowing her to manipulate records without detection. Crundwell also took advantage of the lack of oversight from Dixon’s elected officials, who placed a high level of trust in her due to her long tenure and apparent dedication to her work. Crundwell first started working for the town when she was in high school when she did a one-day internship in the town hall.

The fraud was uncovered when Crundwell took an extended vacation, and a city clerk performing her duties stumbled upon the secret account. After alerting the FBI to the RSCDA account, an investigation revealed the extent of the embezzlement. The town’s reliance on one individual for multiple financial roles were significant contributors to the prolonged undetected fraud.

Lessons Learned

The Dixon fraud case underscores several critical lessons for government auditors. First, the importance of segregation of duties cannot be overstated; no single individual should have control over all aspects of financial transactions. Additionally, fostering a culture of skepticism and diligence among elected officials and staff can act as a deterrent to potential fraudsters. Implementing robust internal controls, such as dual signatures on checks and regular reconciliation of bank statements, can help prevent similar frauds.